Machinery industry 2019 investment strategy: two main lines to grasp structural opportunities.

Release time:

Dec 12,2018

The overall prosperity of the machinery industry has bottomed out since the end of 2016. In 2018, the industry continued to maintain a good prosperity. The company's revenue performance has grown steadily, and the quality of operations has continued to improve. However, it should be noted that from the three quarterly reports, revenue and net profit maintained a good growth but the growth rate has shifted downward, which indicates that the industry's prosperity is still good, but the margin has not continued to rise.

Looking to the 2019, our concerns come mainly from the demand side, specifically the weakening of real estate development, and for infrastructure, it may be a bright spot to hedge against the decline in demand. Looking back at the past three years of the cycle, the new housing construction data well explain the demand fluctuations in the current cycle recovery, while supply-side reforms have exacerbated the imbalance between supply and demand. At the current stage, housing sales data has continued to be sluggish since 2018. The slight improvement in the first half of the year has not changed the trend. At present, construction is still at a high level, and the impact of weakening real estate construction on demand will be huge. The positive side for midstream is that the cost-side pressures that have suppressed industry profits over the past two years will also weaken.

Investment advice: Structural opportunities

In the absence of major changes in policy, taking into account real estate, exports and other factors, the overall demand side of 2019 will face greater pressure, in the context of total pressure, the opportunity is structural. Based on such concerns, we actually downgraded the industry to "neutral" in mid -2018, and looking forward to 2019, we maintain this judgment. Structural opportunities We believe that there are two main lines: first, the main line of industrial upgrading, the proposed focus on the sub-sectors are: lasers, new energy vehicles, semiconductors and industrial automation.

Laser: Laser equipment instead of traditional equipment is the main driving force of the industry, domestic enterprises to high-power products breakthrough, gradually localization is an inevitable trend. Focus on the recommend of domestic fiber laser tap Ruike laser.

New energy vehicles: new energy vehicles is a strategic industry supported by the state, power battery as the core link of domestic power battery manufacturers have the ability to compete globally, first-line power battery manufacturers continue to expand production, pulling lithium-electric equipment into the boom cycle. Optimistic binding line power battery factory lithium-electric equipment leading company, focusing on lithium-electric equipment leading intelligence.

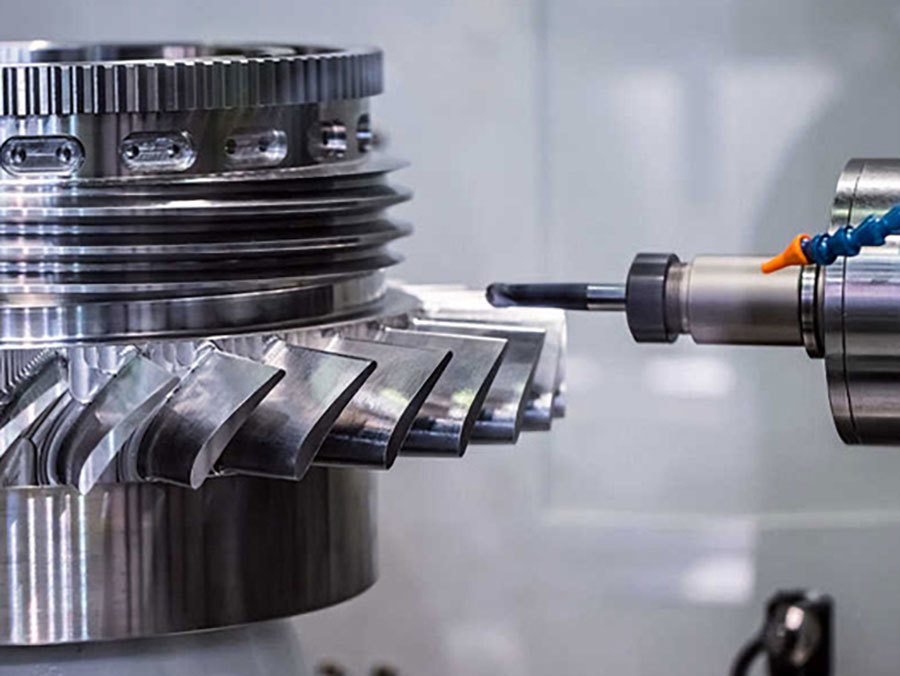

Semiconductor: With the gradual transfer of production capacity to China, superimposed on the state to support the creation of a good policy environment, China's semiconductor equipment industry chain companies ushered in the development opportunities, the future of local semiconductor equipment manufacturers of the alternative space is huge.

Industrial automation: the foundation of manufacturing upgrade lies in the popularization of automation, the basic link of automation is the improvement of robot penetration rate, machine substitution in the manufacturing link is unstoppable, the core components of independent control, import substitution industrialization opportunities are close at hand. Focus on recommend industrial robot leader Eston.

Rail crossing: In the context of macroeconomic growth under pressure rail crossing investment is an important grasp of the stable economy, along with the acceleration of rail crossing investment, rail crossing equipment will also usher in a high business climate, focusing on the recommend of rail crossing equipment leading China.

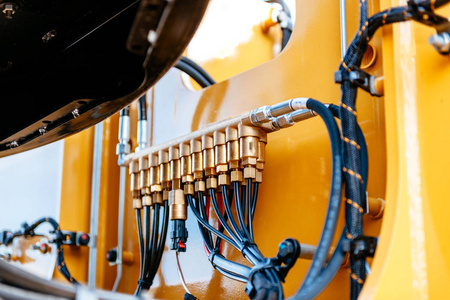

Oil and gas: look at the long demand side of the recovery brought about by the oil price pivot up, focusing on the recommend of oil service fracturing equipment leader Jerry shares.

Industry Key recommend Portfolio

Ruike Laser, Zhejiang Dingli, Pilot Intelligence, China Central Car, Jerry's shares, Precision Electronics, Jack's shares, Easton, Large Family Laser.

Risk Alert

Macroeconomic downturn, overseas exports down, exchange rate fluctuations.